Empower your captive to instantly price cyber risk, give assurance on actual risk intensity and achieve better financial outcomes.

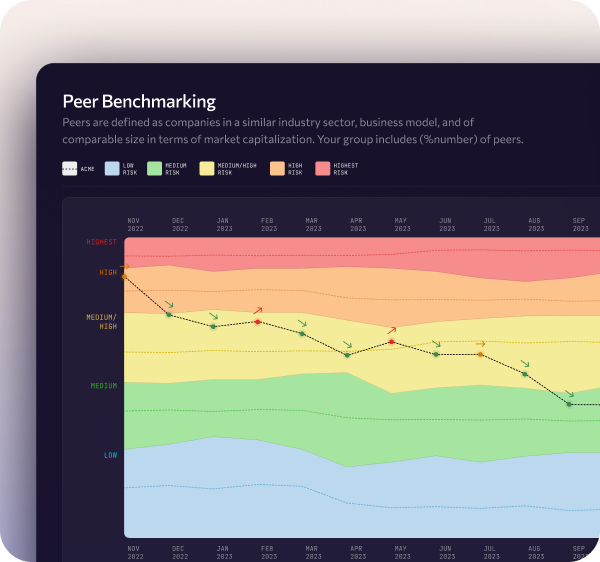

Peer Comps

More accurately price cyber premiums and determine correct size of coverage tower.

Peer benchmarking Understand performance trend relative to peers

3rd Party risk assessment and monitoring Greater assurance on key 3rd parties with dynamic risk reporting for your supply-chain ecosystem. Feature also provides actionable recommendations for proactive vs. reactive risk management.

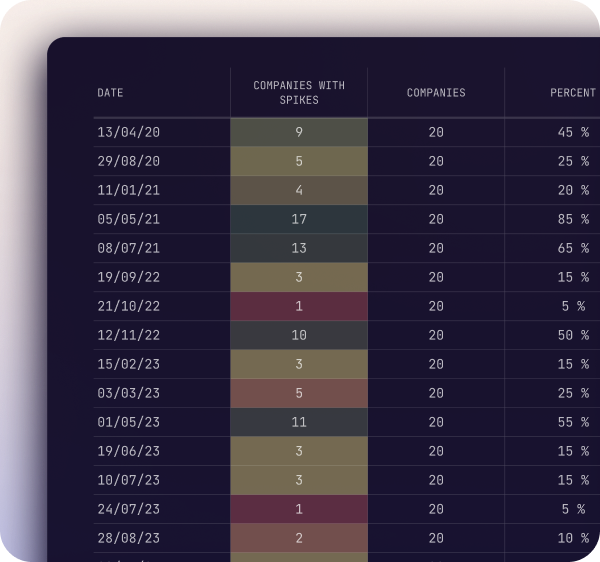

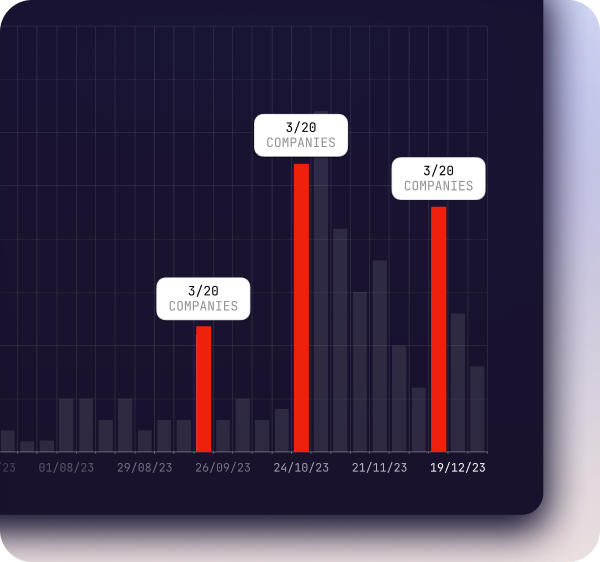

Early Warning

Enable an actionable response to warning signs of an early stage attack - before it grows into a larger loss.

Prioritize Preventive Actions Dynamic Heat Map indicates when and why risk severity changes

See risk at unique scale Powerful risk assessment that instantly moves from macro to micro visibility

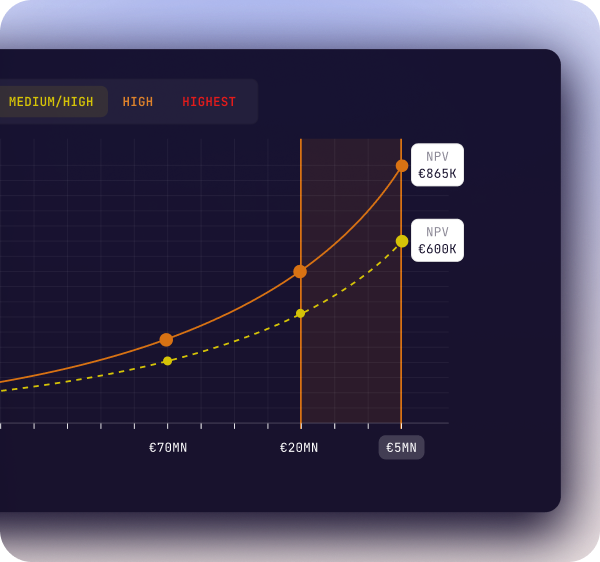

Instant Risk Pricing

Don’t wait for the market to tell you want they think. Now you can price your cyber risk instantly. As often as you want, and as many scenarios as you can think of.

Accurate Risk Pricing Predictive pricing along the full cyber loss curve

Validate Captive Resources Transparent assessment of low severity, high frequency attritional losses from cyber risk

Relevant and Complimentary Cover More options for more cost-effective bursary, primary and excess cyber cover